Retirement Income

WHY RETIRE WITH PEPP

Offering you retirement income options that are secure and flexible, so you have peace of mind knowing you won’t outlive your savings.

We prioritize members not profits - and have no shareholders to pay dividends to.

PEPP's investments are managed by world-class fund managers with a proven track record.

We have been serving members for over 45 years and continue to be the largest defined contribution plan in Canada.

“

With life spans increasing, members need to be thinking about financial longevity to match.

”

Kingsley Igbeta

Director, Pension Administration

Retirement income solutions

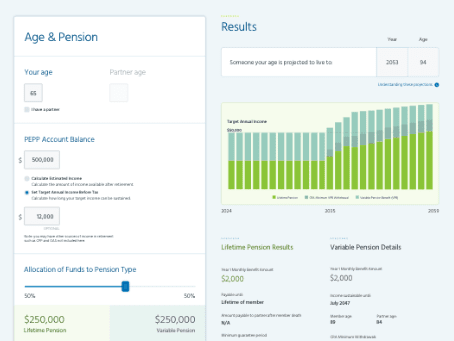

Lifetime Pension

Enjoy a dependable monthly pension payment for life.

PEPP's Lifetime Pension is one of the retirement income options available to you as a Plan member. The Lifetime Pension provides you with dependable monthly payments for life, regardless of how long you live and, depending on the options you choose, your spouse’s life.

The Lifetime Pension is designed to offer you monthly payments that change annually. Payments may be adjusted up or down from year to year; this will help your income keep up with inflation.

- Ends the risk of outliving your retirement savings

- Ability to personalize your survivor benefits

- Designed to potentially offset inflation through future market performance

- Payments may decrease if the investments under perform

- Ideal to budget for known expenses

- Once purchased the funds are permanently locked in

- Customize your retirement with a combination of lifetime pension and variable pension income.

Age Requirement

- Must be at least 50 years of age at time of enrollment

- Under age of 95 at time of enrollment

Fund Requirements

- Minimum purchase amount is $14,000

- Total maximum purchase amount is $1 million

Single Life

If you pass away, payments will continue to be paid to your named beneficiary(ies) for the remainder of the guarantee period you selected.

Joint Life

If you pass away, the Joint Life option provides either 60% or 100% of your monthly payment amount to your spouse for their lifetime.

Guaranteed Periods

Guarantee periods ensure that your monthly payments will continue for a specific amount of time, starting from the date you buy your Lifetime Pension.

Variable Pension Benefit

Have control and flexibility over your retirement savings.

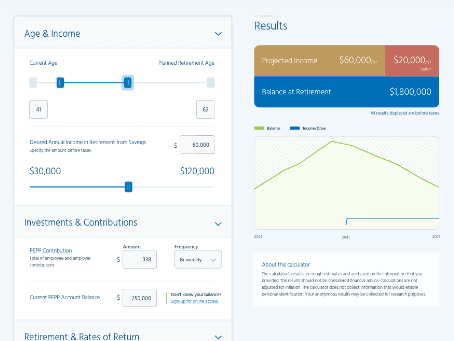

PEPP's Variable Pension Benefit (VPB) is a retirement income option available to you as a Plan member. The VPB provides you with flexibility and control over when and how much retirement income to withdraw, and choice over how your money is invested within the Plan and you will continue to benefit from investment earnings.

Your VPB account is tax-sheltered and tax-deferred until you begin withdrawing payments.

- Your account balance longevity is dependent on your withdrawal pattern

- Flexible payment options to suit your needs

- Your choice as to which PEPP investment funds work best for you

- No required payments until you reach 72 years of age

- Ideal to pay for unknown expenses

- Customize a combination of Variable Pension and Lifetime Pension income.

Age Requirement

- Must be at least 50 years of age at time of enrollment

Fund Requirements

- Minimum account balance is approximately $10,000

PEPP Membership

- You are not currently contributing and have terminated employment with your employer

- You have a PEPP account balance or are able to show prior PEPP membership

- You can choose to receive monthly, annual or lump-sum payments.

- All cash withdrawals from your VPB account are paid directly to your Canadian bank account through Electronic Fund Transfer.

- You can withdraw any amount (less tax) at any time.

- At any time, you can use all or a portion of your VPB account to purchase a Lifetime Pension